*approved transfer means:

a) transfer initiated by an Authorized Representative and approved by another Authorized Representative or

b) executed by an Authorized Representative when the account holder has applied for single-person transaction execution under Article 20(4) of Regulation 2019/1122

** Transfers are processed EXCLUSIVELY on business days.

EU-ETS Union Registry - Frequently Asked Questions

1. Opening an account and updating account data

The application forms are located in the Forms tab.

Before filling out the application form to open or update an account in the Union Registry, individuals designated as Authorized Representatives should already have:

- User identifier in the Union Register system - URID and

- Mobile Unique Device Identifier - MUDI - added to the user's EU Login account (more on this in question 2.2).

Existing users can find their URID after logging into the Union Register. New users should obtain it by following instructions in EU Login User Guide.

Information on how to obtain and check MUDI is provided in section 2.3 of the EU Login User Guide.

- There is a possibility to submit documents:

- issued electronically, e.g., a certificate of residence from the PESEL registry, information from the criminal registry (referred to as e-KRK), or

- electronically signed, e.g., an application form for opening/ updating an account data in the Union Register or an electronically certified copy of an identity document.

- According to par. 3 sec. 2 of of the Terms of use, applications to the Union Register can be electronically signed: with a qualified or trusted signature. Signing a document using a trusted signature can be done through the mObywatel website.

- A certificate of residence from the PESEL registry can be obtained independently by each person through the platform www.obywatel.gov.pl, where one should select the option to download the certificate from the PESEL registry and confirm their identity with a Trusted Profile. It is recommended to download certificates only regarding the place of residence, not with the full range of data.

- In the case of e-KRK obtained through the Ministry of Justice's e-platform, please only send a file in .xml format. (PDF file and its printout do not constitute a formal document and should not be sent.)

- All documents issued electronically or with an electronic signature should be sent to the address rejestr@kobize.pl. Please DO NOT PRINT them and do not send them by traditional mail. Sending paper visualizations/prints of electronic documents prolongs the application review process.

When applying for information from the Criminal Records Registry (KRK) by Authorized Representatives, the legal basis must be provided according to Annex VIII point 5 of Commission Regulation (EU) No 2019/1122 of 12 March 2019 supplementing Directive 2003/87/EC of the European Parliament and of the Council regarding the functioning of the Union Registry (OJ EU L 177/3 of 2.7.2019).

On the other hand, when applying for information from KRK by individuals submitting an application or by representatives (members of the management board) of a legal entity or ultimate beneficial owners, the legal basis must be provided according to Annex IV pkt 8 of the Commission Regulation (EU) No 2019/1122 of 12 March 2019 supplementing Directive 2003/87/EC of the European Parliament and of the Council regarding the functioning of the Union Registry (OJ EU L 177/3 of 2.7.2019).

The information should originate from the criminal register of the country of which the person submitting the document is a citizen and should not be older than three months from the date of submitting the application.

Individuals who are citizens of EU member states other than Poland can submit an application and obtain information in Poland, in the National Criminal Registry. The issued information should then be accompanied by information from the Criminal Register of the country of which the person, whose application concerns, is a citizen. In this case, the application with the request for information must be submitted independently by the person concerned, not by the employer.

Information from the criminal registry should be submitted in the original or in the form of a notarized copy, or in the form of an electronically signed file with a digital certificate, sent to rejestr@kobize.pl.

No. The data in the Union Registry system are verified and changed based on submitted application forms, while personal data in the EU Login system can only be changed independently by the user. However, it should be noted that for the user to seamlessly use their account in the Union Registry, data in both systems should be consistent..

Please find the EU Login User Guide here.

The European Pollutant Release and Transfer Register (E-PRTR) is a system for recording and reporting pollution used by European Union member states. It is closely linked to the implementation of the IPPC Directive (Directive on Integrated Pollution Prevention and Control).

The EPRTR identifier is assigned to each installation subject to reporting obligations for the release and transfer of pollutants and waste outside the place of their origin.

This obligation exists when both of the following conditions are met:

- for carrying out activities listed in Annex I to Regulation E-PRTR No 166/2006 and exceeding the performance threshold specified therein,

- for exceeding the specified threshold values for emissions or transfer outside the place of origin of pollutants contained in wastewater intended for treatment or threshold values for waste specified in Annex II to Regulation E-PRTR No 166/2006.

If the installation does not have an assigned EPRTR number, 'N/a' should be entered in the application form for the Union Registry.

2. EU Login – the authentication system of the European Commission

EU Login is the European Commission's Authentication System, enabling access to websites and online services operated by the European Commission, including the Union Registry.

During each login attempt to the Union Registry, the user is automatically redirected to the EU Login page to verify their identity. Entering the correct user data on the EU Login page, such as email address, previously established access password, and a one-time code obtained by scanning the QR code in the EU Login mobile application, will result in logging into the Union Registry.

The EU Login mobile application was created by the European Commission and is used to verify the identity of users accessing services provided by the Commission. In the process of login to the Union Registry, it replaced the previously used mobile phone number + SMS code.

To ensure proper functioning of the application, it must be installed on a mobile device (cell phone, tablet, etc.) according to the EU Login User Guide.

As a result of correctly conducted installation on the mobile device, a Mobile Unique Device Identifier (MUDI) number will be generated, the first four characters of which should be provided for each user on the application for opening or updating account data.

It should be noted that in case of technical issues with the application, the Commission may decide to switch back to authentication via mobile phone number and SMS, so it is important for the data in the EU Login system and the Union Registry to always be up-to-date and consistent.

Each user of the Union Registry should have one account in the EU Login system with a current and individual email address, mobile phone number, and registered mobile device. Detailed instructions for creating an account in the EU Login system are available in Chapter 1 of the EU Login User Guide.

Points 1 to 3 of the instructions are intended for new users who do not yet have their account in the EU Login system and in the Union Registry.

In case a user forgets the password to their EU Login account, they should use the password reset option by clicking on 'Forgot your password?'. This function is directly available on the EU Login system website.

A link to create a new password will be sent to the user's registered email address in EU Login.

It's important to remember that the password for the EU Login system can only be changed once every 24 hours.

Detailed instructions for changing the email address in the EU Login system are available in Chapter 4.2 of the EU Login User Guide

It should be noted that changing data in EU Login will not affect the data in the Union Registry, and vice versa. To update data in the Union Registry, an application form must be submitted; it is available at: https://formularze.kobize.pl.

Detailed instructions for changing the mobile phone number in the EU Login system are available in Chapter 4.3 of the EU Login User Guide.

It should be noted that changing data in EU Login will not affect the data in the Union Registry, and vice versa. To update data in the Union Registry, an application form must be submitted; it is available at: https://formularze.kobize.pl.

Detailed instructions for changing the mobile device in the EU Login system are available in Chapter 4.1 of the EU Login User Guide.

No. Personal data in the EU Login system can only be changed by the user independently, while data in the Union Registry system is verified and modified by the registry administrator based on submitted application forms. However, it should be noted that for the user to be able to use their account in the Union Registry without any obstacles, data in both systems should be consistent.

The EU Login system user manual is available here.

Please remember that the Android system automatically revokes permissions for applications that have not been launched on the mobile device for a longer period (depending on the settings - from 1 to 6 months). In such a situation, after launching the EU Login application after a long time, a prompt should appear to re-grant permissions.

We remind you to allow the EU Login application to:

- access the device camera(camera access is necessary to enable QR code scanning)

- send notifications.

If the application does not automatically request re-granting permissions, and the 'Initialize' and 'Scan QR code' buttons are inactive (grayed out), you should manually go to the 'Settings' of your phone, select 'Notifications' or 'Apps', and then grant permissions for the EU Login application to access the camera and send notifications.After re-granting permissions, the 'Scan QR code' field should be active.

If both options in the EU Login application, 'Scan QR code' and 'Initialize', are inactive (grayed out), please proceed to question 2.9.

However, if only the 'Initialize' option is active, it means that the mobile device has not been properly connected to the user's account in the EU Login system. New users creating an account in the EU Login system and the Union Registry for the first time should refer to Chapter 2.2 of the EU Login User Guide.

Individuals who are already users of the Union Registry but have changed their mobile device or reinstalled the application on their existing device should refer to the appropriate part of Chapter 4.1 of the EU Login User Guide.

Logging into the Union Registry system is done through the EU Login system. During login, the user enters their email address (or username), password, and selects the authentication method 'EU Login App + QR Code.' This is the only correct way to log into the Union Registry.

Choosing the 'EU Login App + PIN Code' method by mistake will prevent logging into the Union Registry.

In case a user enters an incorrect password six times, access to the EU Login account will be suspended. Account suspension prevents logging in and changing the password for 15 minutes..

If you suspect that the account has been suspended due to an unauthorized attempt to access it, please contact the Registry Administrator by phone at (+48 22 833 24 84) or via email rejestr@kobize.pl.

The European Commission's Authentication System (EU Login) will remind users to change their password every 6 months.

Please note that the EU Login password can only be changed once every 24 hours.

When a mobile device is successfully added to the EU Login account, it obtains so-called MUDI (Mobile Unique Device Identifier).

In order to check the MUDI, one should launch the EU Login application installed on the respective mobile device, navigate to 'Settings', and then select 'About the app'. The MUDI identifier should be visible in this location.

On iOS devices, the MUDI is directly visible upon entering 'Settings'.

3. Installation shutdown/ power below the threshold

In the event of the shutdown of an installation or when the installation no longer meets the criteria for inclusion in the EU ETS system, according to Article 61(2) of the Act of June 12, 2015, on the system of trading greenhouse gas emission allowances, the operator of the installation is obliged to notify in writing within 21 days from the occurrence of the event the competent authority responsible for granting permits and the National Center.

Additionally, the operator of the installation is required to prepare and submit to the National Center a verified emissions report as of the date of the event causing the installation to no longer meet the criteria for inclusion in the system, and then to surrender the appropriate number of allowances as it was stated in the verified report, by September 30 of the following year after the year in which the installation ceased to be included in the system.

According to Article 25 of Commission Regulation (EU) No 2019/1122 (OJ L 177/3 of 2.7.2019), the Registry Administrator may close the Installation Account when the following conditions are met:

- the permit for greenhouse gas emissions for the specific installation has expired,

- emission values for all years of the installation's coverage under the EU ETS system have been entered into the Registry,

- emissions from the installation have been settled,

- compliance status for the installation has been calculated (more about compliance status in question 7.8),

- the operator of the installation has no outstanding surplus allowances to return, and

- the account balance is zero.

4. Transfer of rights to use the installation to another entity

In the event of acquiring an installation covered by the EU ETS system, the new operator is required, according to Article 61(2) of the Act of June 12 2015 on the system of greenhouse gas emission allowances trading, to notify the National Center within 21 days (from the date of the event) of acquiring legal title to the installation.

Additionally, the operator who has acquired ownership rights to the installation covered by the EU ETS system is obligated to submit the following documents to the National Center:

- a properly completed and signed application form,

- an updated permit for greenhouse gas emissions issued by the competent authority - under Article 55 of the aforementioned Act, indicating the acquirer as the operator of the installation,

- all documents required as attachments when opening an account, unless they have already been submitted. The list of required attachments is available in the Instructions for opening and updating account data in the Polish part of the Union Registry.

Upon submission of the complete set of correct documents by the operator, the National Center will carry out the appropriate update in the Union Registry related to the change of the operator.

It is also reminded that according to Article 61(4) of the aforementioned Act, the seller of the legal title to the installation covered by the system is obliged to provide the buyer with all necessary information and documents for preparing an emission report. Additionally, it is recommended that the installation buyer obtains written confirmation from the previous owner regarding the account balance assigned to the installation on the day of its takeover. In the case of a positive balance, the new owner, upon presenting a document confirming ownership of the installation title, should apply to the registry administrator with a written request to suspend access to the account for persons assigned to it by the previous operator. More information on account access suspension is available in section 8. Lack of access to the Account.

According to Article 61(3) of the Act of June 12, 2015, on the system of greenhouse gas emission allowances trading, the purchaser of the legal title to an installation covered by the system is obligated to account for the emissions from that installation.

This means that if the acquisition of the installation occurs before March 31 of a given year, the purchaser must prepare an emission report for the previous year if the seller did not submit an emission report at the time of the acquisition.

If the acquisition of the installation takes place after March 31 of a given year, the purchaser is required to submit an emission report for the entire calendar year in which the acquisition occurred.

The seller of the legal title to an installation covered by the system is obliged, under Article 61(4) of the aforementioned Act, to provide the purchaser with all necessary information and documents for preparing an emission report.

5. Authorised Representatives

In the Union Registry it is allowed to appoint to an account from two to eight of Authorized Representatives.

Before completing the application form for opening or updating an account data, each Authorized Representative must have an individual URID and MUDI identifiers (more on this in question 2.2).

New users may obtain URID and MUDI by following the EU Login User Guide.

Activated users may check their URID after logging into the Union Registry; whereas the MUDI should be checked on the mobile device used for logging into the Registry (e.g., phone, tablet) (see question 2.14).

Each Authorized Representative who is assigned to an account fulfills one of the roles listed in the table below.

Table 1. Roles and permissions of Authorized Representatives

| No. | Roles | Symbol of the role | Permission to: |

| 1 | Initiate only | I | initiate processes, e.g. initiate transactions, add an account to TAL (Trusted Account List) |

| 2 | Approve only | Z | approve processes, initiated by another person, e.g. confirm transactions, add an account to TAL |

| 3 | Initiate and approve | I+Z | initiate processes and approve processes initiated by another user |

| 4 | Read only | O | see only the account data |

In the application, you can designate from two to eight Authorized Representatives. Regardless the number of individuals assigned to an account, at least two Authorized Representatives must have roles assigned according to one of four combinations presented in the table below.

Each subsequent Authorized Representative can fulfill any of the roles indicated in Table 1.

Table 2. Possible roles' combinations when only two people are assigned to an account.

| No. | User 1 | User 2 |

|---|---|---|

| 1 | I | Z |

| 2 | I+Z | Z |

| 3 | I | I+Z |

| 4 | I+Z | I+Z |

Individuals assigned to an account in the Union Registry receive authorization to perform all actions on the account and to contact the National Center. The account holder bears full responsibility for selecting representatives and their operations on the account. Therefore, the role of an Authorized Representative should be entrusted to competent and trustworthy individuals.

Authorized Representatives do not need to be individuals listed as the company's representation document.

This process involves submitting an application form to the National Center, which is provided Here.

6. Transactions

The Trusted Accounts List (TAL) is the list of accounts to which transfers occur without delay.

Before executing a transfer, the destination account number must be added to the TAL.

As per Article 23(4) of Regulation 2019/1122, an account will be added to the TAL at 12:00 on the 4th working day from the approval of the task to add the account to the TAL. The task must be created by one Authorized Representative and approved by another.

Conversely, removing an account from the TAL happens instantly.

All accounts belonging to the same entity are automatically added to the Trusted Accounts List with each account, meaning the account holder doesn't need to add their own accounts to the TAL.

For all types of accounts in the Union Registry, it is possible to create the so-called Trusted Accounts List - TAL (more information about TAL in question 6.1).

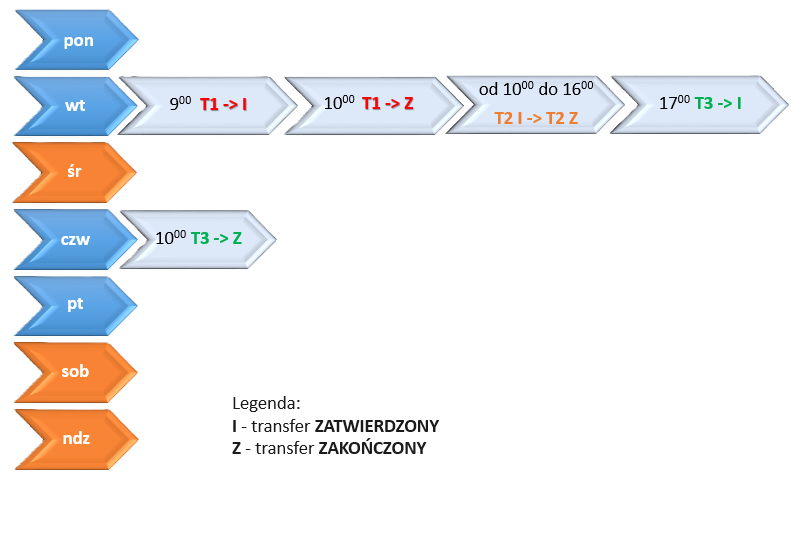

Transfers to accounts on the TAL are executed immediately after their approval, between 10:00 and 16:00 Central European Time (CET/CEST), on working days.

If a transaction is initiated outside of this time frame, it will be executed at 10:00 on the next working day (see table below).

| Transfers of allowances to accounts on TAL

(Art. 35 (2) of the regulation 2019/1122) |

|||

|---|---|---|---|

| Approved* on day X**: | till 10 a.m. | between 10 a.m. - 4 p.m. | after 4 p.m. |

| Executed: | at 10 a.m. of the X day | immediately | at 10 a.m. of the X+1 day |

Transaction processing scheme for accounts located on the Trusted Account List (TAL)

The rules mentioned above do not apply to surrender transactions (more on this in question 7.3).

The guidelines for transaction execution is extensively explained in the Union Registry User Manual accessible to Authorized Representatives logged into the Union Registry, under the Help section.

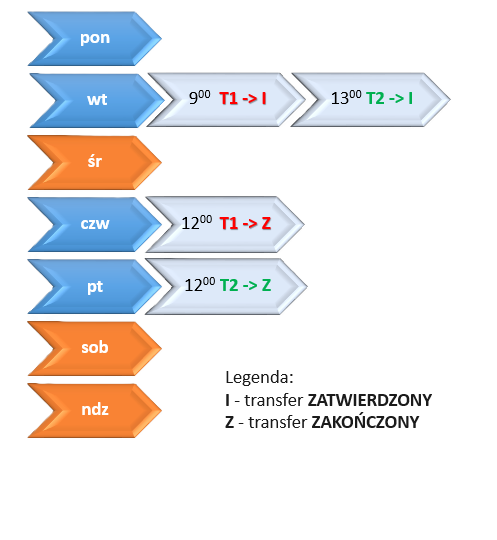

Executing a transfer to an account that is not on the Trusted Account List (TAL) is subject to delay and is possible from Trading Accounts.

Additionally, the holder of an Installation Account, Aircraft Operator Account, or Maritime Operator Account, pursuant to Art. 55(3) of Regulation 2019/1122, may submit a request to the administrator to enable transactions to accounts outside the TAL.

A transaction approved before 12:00 p.m. on day X will be completed by 12:00 p.m. on day X+1. Conversely, a transaction approved after 12:00 p.m. on day X will be completed by 12:00 p.m. on day X+2. This means that the transaction processing time can range from 24 to 48 hours and runs exclusively on business days.

| Transfers of allowances to accounts outside TAL

(Art. 35 (3) regulation 2019/1122) |

||

| Approved* on day X**: | before 12 p.m. | after 12 p.m. |

| Executed: | at 12 p.m. of day X+1 | at 12 p.m. of day X+2 |

*approved transfer means:

a) transfer initiated by an Authorized Representative and approved by another Authorized Representative or

b) executed by an Authorized Representative when the account holder has applied for single-person transaction execution under Article 20(4) of Regulation 2019/1122

** Transfers are processed EXCLUSIVELY on business days.

Transaction processing scheme for accounts located outside the Trusted Account List (TAL)

The rules mentioned above do not apply to surrender transactions (more on this in question 7.3).

The guidelines for transaction execution is extensively explained in the Union Registry User Manual accessible to Authorized Representatives logged into the Union Registry, under the Help section.

For security reasons, transactions in the Union Registry are carried out within strictly defined time frames.

The processing rules for transactions in the Union Registry are as follows:

- for accounts located on the Trusted Account List (TAL) - seequestion 6.2

- for accounts outside of the Trusted Account List (TAL) - see question 6.3

The guidelines for transaction execution is extensively explained in the Union Registry User Manual accessible to Authorized Representatives logged into the Union Registry, under the Help section.

Since the beginning of 2024, the transfer of allowances between the Union Registry and the Swiss registry takes place daily from Monday to Friday. Information about public holidays is available on the Swiss registry website.

Transactions of allowances between both systems can be initiated at any time by market participants. Transactions will then be executed at the next available date, following the rules applicable in the registry where the transfer was initiated.

Processing rules for transactions in the Union Registry are as follows:

- for accounts located on the Trusted Account List (TAL) - see question 6.2

- for accounts outside of the Trusted Account List (TAL) - see question 6.3

Yes, provided that, based on Article 55(3) of Regulation 2019/1122, the account holder submits a request to the Administrator to enable transactions on accounts outside the Trusted Account List (TAL). Such transfers occur with a delay (see question 6.3).

Yes. This type of transfer takes place with a delay (see question 6.3).

Pursuant to Article 20(4) of Regulation 2019/1122, the account holder may submit a declaration of intent for transactions from their accounts on the Trusted Account List (TAL) (see question 6.1) to be executed only by one Authorized Representative* (without a need to confirm such transfer by another Authorized Representative).

Submitting the declaration also allows for execution of surrender transactions only by one person (see question 7.3).

* An Authorized Representative capable of independently conducting transactions must be assigned one of the roles: Initiate only (I) or initiate and approve (I+Z) (see question 5.2)

According to the provisions of Article 35(5) or (6) of Regulation 2019/1122 the Authorized Representative has the right to abort an unfinished transaction independently or with the assistance of the administrator, at least 2 hours before the completion of the transfer.

This is only allowed in cases where the transaction was initiated from an account outside the Trusted Account List (TAL): (see question 6.3):

- erroneously or

- Illegally.

If the transaction abortion occurred due to suspicion of misuse, the account holder is obliged to immediately report this fact to the appropriate national law enforcement authority. The account holder shall provide a copy of the report to the administrator within 7 working days.

According to Article 55(4) of Regulation 2019/1122, the Authorized Representative initiating a transfer in the Union Registry is required to indicate whether it constitutes a bilateral transaction.

A BILATERAL transaction is one conducted off-exchange or over-the-counter (OTC), between two parties without intermediaries.

Transactions registered in an authorized trading system or settled with a central counterparty are examples of NON-BILATERAL transactions. Transfers between different accounts of the same account holder should always be indicated as NON-BILATERAL.

In the Union Registry system, there is a one-time transaction threshold determined by the Central Administrator (the European Commission), set at level of 2 million units for transactions executed to accounts outside the Trusted Accounts List (TAL).

Additionally, Authorized Representatives assigned to accounts have the option to set additional limits. These limits are voluntary and apply to transactions executed both to accounts on TAL and outside of TAL. It is possible to set limits for:

- single transactions,

- daily,

- weekly (last 7 days),

- weekly (Monday to Friday, working days),

- monthly (calendar month).

These limits do not apply to surrender transactions.

7. Compliance

According to Article 92 of the Act of June 12, 2015, on the greenhouse gas emission trading system, starting from the year 2024, installations' and aircrafts' operators are obliged to surrender by September 30th of each year emission allowances in a quantity corresponding to the difference between the total allowances surrendered in the accounting period and the sum of emissions from installation's/aviation's activities (as referred to in Article 91(4) of the aforementioned Act).

The emission settlement consists of the following stages:

- After the end of the calendar year, the operator of an installation or aircraft(s) prepares a report on emissions from installation's/ aviation's activities. The report must be verified and approved by an authorized verifier.

- By March 31st, the operator of an installation or aircraft(s) is obligated to submit the verified report to the National Center in writing and electronically, to the email address: roczne_raporty@kobize.pl. The day the report reaches the National Center's headquarters is considered the day of submission.

- The National Center enters emission values from verified reports into the Union Registry.

If on April 1st any installation or aircraft does not have an entry in the table of verified emissions, the account of such installation or aircraft is automatically blocked, regardless of the reason why emission data has not been entered. The blockade applies to all outgoing transfers from the account, except for surrender transactions, and lasts until a verified emission value is entered into the registry. - By September 30th, the operator of an installation or aircraft(s) must carry out the surrender operation in a quantity corresponding to the verified emissions from the previous year (more on surrender in question 7.3).

Surrender is only carried out from the Installation's or aircraft(s)' operator account to which this emission applies. Surrendering allowances from another account is incorrect and will not be accepted.

If by the end of September the operator of an installation or aircraft(s) has not settled emissions in the appropriate quantity, they are subject to a financial penalty, which amounts to 100 Euros (adjusted by HICP) per tonne of CO2 not covered by surrendered units.

Based on the provisions of Directive 2003/87/EC, the deadline for settling emissions from maritime operations is the same as for installations' and aircraft(s)' operators – namely, September 30th of the year following the year in which the emission was generated.

According to Article 3gb of Directive 2003/87/EC in the years 2025-2026, maritime enterprises will be able to benefit from derogations, i.e., to settle a portion of the emitted emissions, as follows:

- 40% of the verified emissions generated in 2024;

- 70% of the verified emissions generated in 2025.

The first year from which maritime ship operators will settle 100% of verified emissions will be 2027, for emissions generated in the year 2026.

If by the end of September (starting from 2025) maritime ship operators fail to settle emissions in the appropriate quantity, they are subject to a financial penalty, amounting to the equivalent of 100 Euros (adjusted by HICP) per tonne of CO2 not covered by surrendered units.

Maritime ship operators can use any type of units to settle emissions from their operations, including: EUA, EUAA, CHU, CHUA. (See question 7.5)

Emission settlements must be fulfilled by executing a transaction from an Installation Account, Aircraft Operator Account or Maritime Ship Operator Account - 'Surrender of allowances', i.e., transferring the appropriate number of units to the EU surrender account ( EU-100-5016380-0-3), which is by default located on the Trusted Accounts List - TAL (see question 6.1).

Unlike other types of transactions carried out from accounts on TAL, surrender of allowances can be executed 24/7 and is processed immediately.

By default, the surrender of allowances transaction requires confirmation by another Authorized Representative (other than the one who entered it into the registry system).

However, the account holder may decide that the surrender and other types of transactions from their account to accounts located on TAL can only be performed by one Authorized Representative*. To do so, they must submit to the Administrator a declaration of intent under Article 20(4) of Regulation 2019/1122.

* An Authorized Representative able to independently execute transactions must be assigned one of following roles: Initiate only (I) or Initiate and approve (I+Z) (see question 5.2).

The process of surrendering allowances is described in detail in the User Manual of the Union Registry available (under the Help tab) to Authorized Representatives logged into the Union Registry.

The installations' operators, aircraft(s)' operators, and maritime enterprises are obliged to carry out surrender transactions (of EUA/EUAA or CHU/CHUA units*) by September 30th of each year, corresponding to the verified actual emission quantity of the preceding year. (The exception is surrendering emissions from maritime operations, generated in years 2024-2025 – see question 7.2.)

The table below presents the types of units (and their periods of origin) that operators can use for the settlement of emissions in Phase 3 and Phase 4.

| EMISSIONS FROM: | PERIOD OF GENERATED EMISSIONS | UNITS | UNITS' ORIGINATING PHASE** | |||

|---|---|---|---|---|---|---|

| EUA | EUAA | CHU* | CHUA* | |||

| INSTALLATIONS | Before year 2021 | PHASE 3 | ||||

| AIRCRAFT(S)' OPERATIONS | PHASES 3 and 4 | |||||

| INSTALLATIONS | From year 2021 inclusive | PHASES 3 and 4 | ||||

| AIRCRAFT(S)' OPERATIONS | ||||||

| MARITIME OPERATIONS | ||||||

* units originating in Swiss Registry: CHU -units for installations; CHUA - units for aircraft operators

** Phase 3 means units originating in years: 2008-2012 i 2013-2020; Phase 4 means units originating in years: 2021-2030

According to Commission Implementing Decision (EU) 2024/411 of 30 January 2024, the maritime operator account (MOHA) must be opened by the entity listed in the annex to the aforementioned decision, in the part of the Union Registry administered by the Member State where that entity is designated.

More issues concerning maritime operators have been discussed in frequently asked questions – ETS maritime FAQ, prepared by the European Commission.

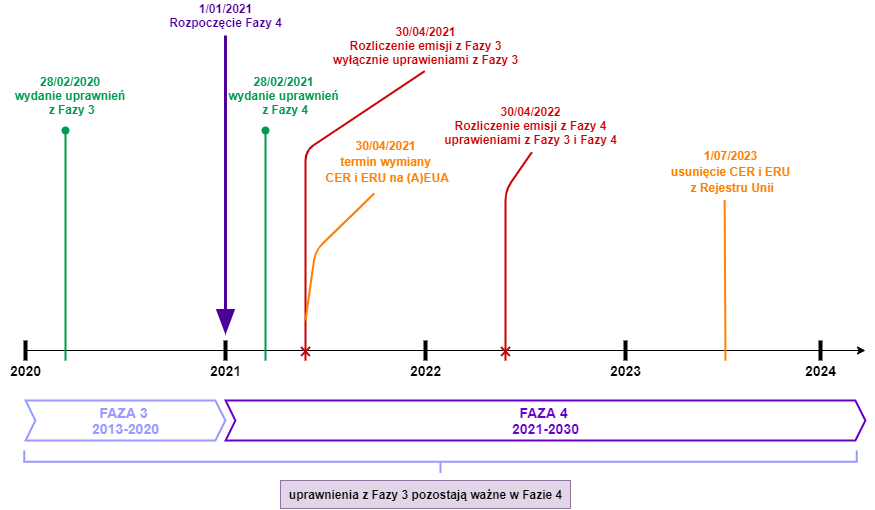

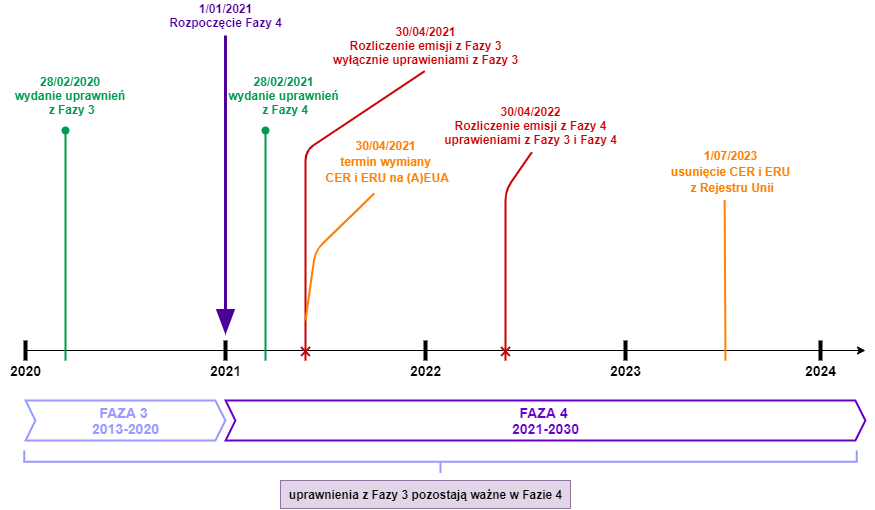

According to Article 56(2) of Regulation 2019/1122, for the settlement of emissions generated in Phase 3 (2013-2020), only units created in the same phase can be used. In other words,emission allowances from Phase 4 (2021-2030) may not be used for settling emissions from Phase 3.

As of January 1, 2021, in the Union Registry, all emission allowances are labeled with information about the phase of their origin (pursuant to Article 37(3) of the aforementioned regulation).

According to Article 13 of Directive 2003/87/EC and Article 16(1) of the Act of June 12, 2015, on the greenhouse gas emission allowance trading system, emission allowances (EUAs) issued in Phase 3 will remain valid in subsequent phases.

As of January 1, 2021, in the Union Registry, all emission allowances are labeled with information indicating the ten-year period in which they were created (based on Article 37(3) of Regulation 2019/1122).).

Article 33(1) of Regulation 2019/1122 states that the compliance status for the last year of emissions will be calculated before the account is closed.

This means that if the account holder submits a verified emissions report for the last year of operation to the National Center, surrenders the appropriate number of allowances, and has no outstanding obligations in the system, with a zero account balance, the national administrator will have the option to close such account (see question 3.2), with no need to wait till October 1 of the following year to calculate the compliance status, as was the case in previous phases of the EU ETS system.

According to Article 33(2) of the aforementioned regulation, starting from the period beginning on January 1, 2021, the so-called correction factor reflects the compliance status from the last year of the previous period>.

This means that unlike in previous accounting periods, in the event of an excess surrender of allowances (e.g., due to a downward correction of emission values or as a result of mistakenly surrendering a greater number of allowances), the surrendered units will not be lost but will be credited towards the emissions settlement in the first year of the subsequent accounting period.

According to Article 104 of the Act of June 12, 2015, on the system of trading greenhouse gas emission allowances, failure to surrender allowances within the specified period subjects the account holder to a monetary penalty. The amount of the penalty equals the product of the number of emission allowances not surrendered and the unit penalty rate. The unit penalty rate is 100 Euros (adjusted by HICP).

Settling payments related to the imposed penalty does not exempt from the obligation to transfer the appropriate number of units to the surrender account for the settlement of outstanding emissions.

8. Lack of access to the account

According to Article 32 of Commission Regulation (EU) No 2019/1122, if the verified emissions for a specific installation, aircraft operator, or shipping company are not entered into the registry by April 1st of a given year, the respective account is automatically blocked.

The account blockade remains in place until the verified emission quantity is entered into the system.

The account is blocked due to the failure to enter the verified emission quantity into the system by the end of March of a given year. This indicates a state of the account where outgoing transfers cannot be processed except for the execution of surrender transactions.

Incoming transfers to the blocked account are processed without any issues.

According to Article 30 of Regulation 2019/1122, the Administrator may suspend an account or access of Authorized Representatives to the account in situations where they know or have reasonable grounds to believe that an Authorized Representative has:

- attempted to access accounts or processes without authorization;

- made multiple attempts to access the account or process using incorrect username or password;

- attempted to breach the security, availability, integrity, or confidentiality of the Union Registry or EUTL, or the data processed or stored therein;

or if one of the following conditions is met:

- the account holder has died without a legal successor or ceased to exist as a legal entity;

- the account holder has not paid fees;

- the account holder has violated the terms of the Terms of use concerning detailed technical conditions for opening, managing and closing accounts in the Polish part of the Union Registry;

- the account holder has not consented to changes made by the National Administrator or Central Administrator;

- the account holder has not reported changes in account information or provided evidence required for changes or for providing information for a new account;

- the account holder has not fulfilled the requirement of a Member State that at least one Authorized Representative must have a permanent residence in the territory of the Member State of the National Administrator;

- the account holder has not fulfilled the requirement of a Member State that the account holder must have a permanent establishment or be registered in the Member State of the account administrator;

- if the National Administrator has reasonable grounds to believe that the account will be or has been used in fraud, money laundering, terrorism financing, corruption, or other serious crimes (for a maximum of 4 weeks);

- based on national law provisions serving a legitimate purpose and in accordance with them.

In the latter case, according to Article 92a of the Act of June 12, 2015, on the system of greenhouse gas emission allowances trading, access to the installation or aircraft operator's account will be suspended if there is an outstanding emission quantity on that account.

The suspension of an account means that Authorized Representatives do not have access to the account data. No operations can be performed on a suspended account. Incoming transfers to the suspended account are processed without any issues.

The suspension of one account does not affect the operation of other accounts held by the same account holder.

9. Fees

For opening an account, a fee of 2 000 PLN is paid, in accordance with Article 13 of the Act of June 12, 2015, on the greenhouse gas emission allowance trading system. .

Proof of payment of the fee must be attached to the application form for opening an account in the Union Registry.

All payments related to the opening and maintenance of an account in the Union Registry should be made to a separate bank account of the National Fund for Environmental Protection and Water Management:

BGK III/o Warsaw account id: 22 1130 1062 0000 0109 9520 0012, SWIFT code: GOSK PL PW.

By March 31 of each year, the account holder pays a fee of 500 PLN, in accordance with Article 13 of the Act of June 12, 2015, on the greenhouse gas emission allowance trading system. This fee is not paid for the year in which the fee for opening the account was paid.

All payments related to the opening and maintenance of an account in the Union Registry should be made to a separate bank account of the National Fund for Environmental Protection and Water Management:

BGK III/o Warsaw account id: 22 1130 1062 0000 0109 9520 0012, SWIFT code: GOSK PL PW.

10. Guidance documentation

The User Manual is intended exclusively for individuals designated as Authorized Representatives in the Union Registry. The link to the User Manual page is sent to users of the system along with the Activation Key or to the user's registered address in the system.

The manual is also available in the Help section of the Union Registry website.

11. Other questions

Legal acts regulating the obligation to have an LEI code include the EU Directive - MiFID II, i.e., the Directive on European Financial Markets, and its implementing EU Regulation No. 600/2014, known as MiFIR Regulation. The obligation to have an LEI code applies to every legal entity that engages in financial market transactions since mid-2018, including buying and selling stocks, bonds, guarantees, government bonds, and derivatives. Entities obliged to have an LEI code include:

- Banks,

- Credit institutions,

- Brokers,

- Pension and investment funds.

Non-financial entities, such as companies and individuals conducting business activities, are also required to have an LEI code if they engage in financial transactions and are obliged to report on the transactions carried out within this activity. Entities not obligated to have an LEI code include individuals conducting business activities but investing outside of that business. Every entity that has been assigned an LEI identifier according to Article 26 of EU Regulation No. 600/2014 is required to provide this information to the national administrator using the appropriate application form .

More information about LEI can be found on the website https://www.gleif.org/en/

a) In the case of a legal entity other than a partnership whose securities are admitted to trading on a regulated market subject to disclosure requirements arising from EU law or equivalent third-country law:

- a natural person who is a shareholder or stockholder of the entity, holding ownership rights to more than 25% of the total number of shares or stocks of that legal person,

- a natural person holding more than 25% of the total voting rights in the governing body of the entity, also as a pledgee or usufructuary, or based on agreements with other voting rights holders,

- a natural person exercising control over the legal person or legal persons collectively holding ownership rights to more than 25% of the total number of shares or stocks of the entity, or collectively holding more than 25% of the total voting rights in the governing body of the entity, also as a pledgee or usufructuary, or based on agreements with other voting rights holders,

- a natural person exercising control over the entity by holding rights as referred to in Article 3(1)(37) of the Act of September 29, 1994, on accounting (hereinafter: the Accounting Act), or

- A natural person occupying a senior management position in case of documented impossibility to establish or doubts about the identity of natural persons specified in the preceding points and in case of no suspicion of money laundering or terrorism financing.

- the settlor,

- the trustee,

- the supervisor, if appointed,

- the beneficiary, or

- another person exercising control over the trust.

In Phase 4, there is no possibility of using, i.e., converting to EUAs, Kyoto units (CER and ERU).

The conversion of Kyoto units to EUAs, within the granted conversion limit, was possible until April 30, 2021 - i.e., until the end of the emission settlement period for the year 2020 (end of Phase 3).

The conversion of Kyoto units to EUAs, within the granted conversion limit, was possible until April 30, 2021 - until the end of the emission settlement period for the year 2020 (end of Phase 3).

However, given that on July 12, 2023, the Central Administrator transmitted the list referred to in Article 85(2) of the aforementioned regulation to the National Administrator, until September 9, 2023, Kyoto units could had been been: transferred to another account labeled 'PL' or to a national account belonging to Poland with the identifier PL-100-2-0-40, or voluntarily cancelled.

After September 9, 2023, it is only possible to cancel Kyoto units.